The importance of capital in startups lies in their ability to finance product development, conduct market testing, scale operations and ultimately compete in a global environment. Investment funds, such as venture capital, play a crucial role in providing not only capital but also strategic advice and valuable connections that can make the difference between the success and failure of a startup.

Recommended Lecture Ultimate Guide: Preparing for an investment round

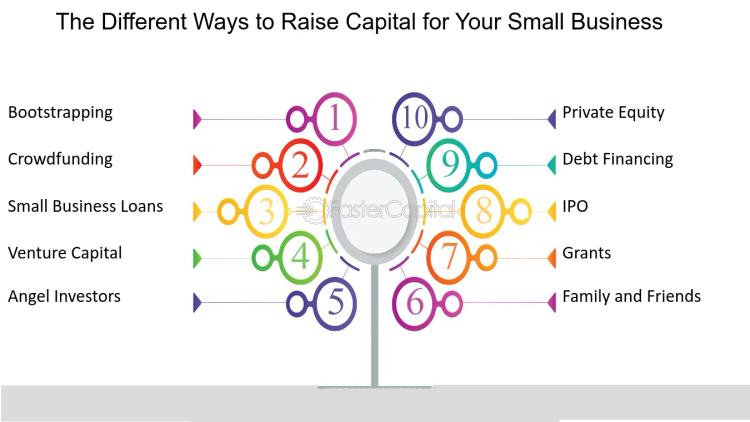

Bootstrapping vs Venture Capital vs Crowdfunding vs Angel Investors vs Incubators vs Accelerators

Bootstrapping

Bootstrapping involves funding your startup with your resources, without external financing. This way is ideal for Startups with low initial costs, and founders with self-funding capabilities.

Advantages:

Total control over your company, your vision, and your decision-making.

Total ownership: You do not cede any stake in your company to outside investors.

Independence: You do not have to respond to the demands or expectations of investors.

Profitability: You can generate profits from the start, without having to pay interest or dilute your equity.

Flexibility: You can make decisions quickly and adapt your business as needed without investor approval.

Disadvantages:

Limited resources: Your ability to grow will be limited by your financial resources.

Slow progress: Growth may be slower than with venture capital, as you do not have a significant initial injection.

Venture Capital

Venture Capital involves funding in exchange for an equity stake in your startup. This can be an excellent option for startups with great growth potential and needing funding to scale quickly.

Advantages:

Access to a significant capital injection to fund the growth of your business.

Experience and support: Venture capital investors often bring industry expertise, contacts, and additional resources that can be valuable to your company.

Accelerated growth: With the right capital, you can grow your business faster and reach a broader market.

Validation: Receiving venture capital funding can validate your business idea and increase your credibility with customers, partners, and future employees.

Opportunities: You can access growth opportunities that would not be possible with limited resources.

Disadvantages:

Loss of control: You give up some ownership and control of your business to outside investors.

Pressure to succeed: Venture capital investors expect a significant return on their investment, which can create pressure to grow your business quickly and achieve specific goals.

Different objectives: Venture capital investors' goals may not align with your long-term vision for the business.

Crowdfunding

Crowdfunding is a form of collective financing in which many people contribute small amounts of money to support a project or business. In the case of startups, Crowdfunding can be a good option to, mainly, generate visibility for your brand.

Strategies for a Successful Crowdfunding Campaign

Clearly define the goal: Set a realistic funding target and communicate it effectively.

Create a compelling story: Present the idea attractively and emotionally to connect with potential backers.

Offer attractive rewards: Incentivize backers with rewards that add value.

Advantages and Challenges of Crowdfunding

Advantages:

Access to funding without giving up equity.

Validation of the idea through public interest.

Challenges:

Requires a significant investment of time and effort in marketing.

No guarantee of success; many campaigns fail to reach their funding goal.

Success Story:

Pebble Watch: In 2012, the Pebble Watch raised over $10 million on Kickstarter to develop its smartwatch. The watch became one of the most popular crowdfunding products, and thanks to its success the company's ownership was bought by Fitbit.

Incubators

Incubators are organizations that support startups in their early stages, providing resources such as workspaces, mentorship, training, and sometimes funding in exchange for equity. Their goal is to help entrepreneurs develop their ideas and turn them into viable businesses.

Benefits of an Incubator

Mentorship and guidance

Access to experts in various areas who can guide entrepreneurs.

Networking opportunities

Chances to connect with other entrepreneurs, investors, and industry professionals.

Shared resources

Workspaces and tools that reduce initial costs.

Accelerators

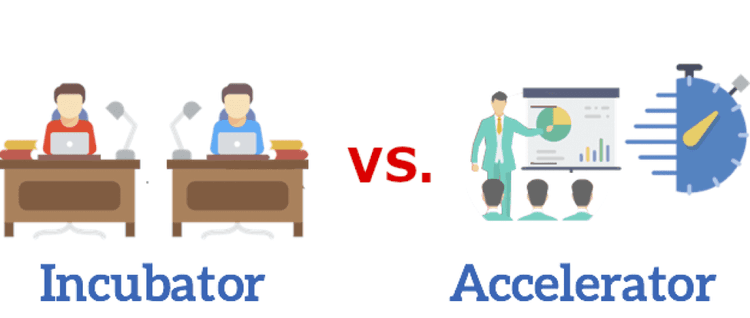

Differences Between Incubators and Accelerators

Incubators focus on startups in the early stages, helping them develop their ideas and business models. In contrast, accelerators work with companies with a minimum viable product (MVP) and seek to scale quickly. Accelerators often have a structured program with a specific duration, while incubators may offer more prolonged and flexible support.

Application and Selection Process

The application process for an accelerator typically includes:

Submitting an application

Presenting the idea, team, and business model.

Interviews

Selection of candidates through interviews with mentors and directors of the accelerator.

Acceleration program

Selected startups participate in an intensive program that includes mentorship, workshops, and networking opportunities.

Examples of Successful Acceleration Programs

Y Combinator

One of the most famous incubators has supported startups like Dropbox and Airbnb.

Techstars

Offers programs in several cities around the world and has supported over 2,000 startups.

Seedcamp

Focuses on European startups and provides access to a network of investors and experts.

Angel Investors

What Angel Investors Are

Angel investors are individuals who invest their capital in startups in exchange for equity. They are often experienced entrepreneurs or executives looking to support new businesses and share their knowledge.

How to Find and Attract Angel Investors

Investor networks

Participate in networking events and conferences where angel investors gather.

Online platforms

Use platforms that connect startups with investors, such as AngelList.

Referrals

Ask industry contacts to introduce you to angel investors.

Pros and Cons of Working with Angel Investors

Pros:

Provide not only capital but also experience and contacts.

Tend to be more flexible than venture capital funds.

Cons:

May require a significant stake in the company.

The relationship can be more personal, which can complicate the work dynamic.

What is the best funding approach for your startup?

In conclusion, the choice of financing will depend on the unique characteristics of each startup, its objectives, its risk tolerance, and its stage of development. The right choice will be crucial to the success of your startup.

Recommendations

Develop a solid business plan: The plan should include clear objectives, funding strategies, financial projections, and market analysis.

Build a network of contacts: Attend startup events, connect with mentors and investors, and participate in online communities.

Be flexible and adaptable: The funding landscape can change, so it is important to be prepared to adjust your strategy as needed.

Don't give up: The search for funding can be a long and challenging process, but perseverance and determination are key to success.